Trump: chip courses are 100% tax Required, Apple investment in the United States has increased to $60 billion

Trump announced today in the White House Office that Apple has expanded its investment in the United States to US$60 billion, including investment to expand its local factories of multiple American companies. In addition, he plans to charge 100% tax on chips.

Accompanied by Vice President Vans, Finance Minister Bescent, Commerce Secretary Lutnik and Apple Executive Director Kuck, Trump held a reporter meeting in the White House Office, announcing that Apple would increase its commitment to invest in U.S. dollars in February this year from $50 billion to $60 billion.

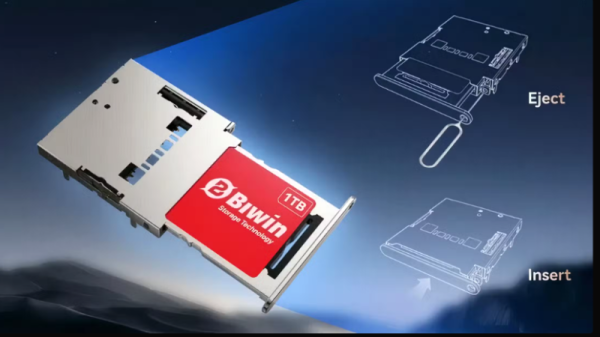

Apple will build the largest smart glass factory in the United States in Harrodsburg, Kentucky. In addition, the investment will include American companies supporting supply chains, including Conning, Texas instruments, application materials and MP Meterials, etc., to increase the production of Apple electronic products in the United States.

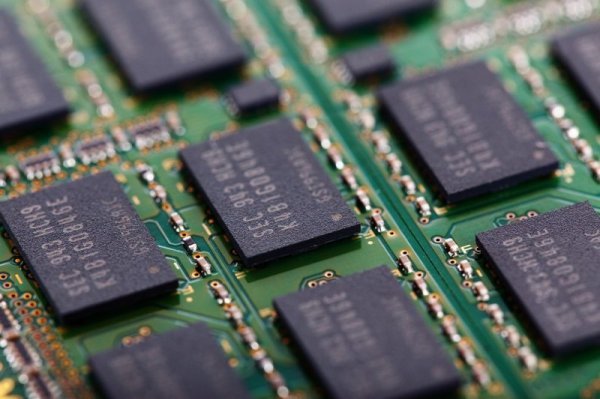

In addition, Trump said he plans to charge 100% tax on chips and semiconductor classes, but as long as the company promises to produce locally in the United States, even if the factory has not completed or even has not yet been operated, the tax can be exempted. However, if there is no action after the promise, the US government will calculate the accumulated tax and ask the country to pay.

Since NTD has established a wafer factory in Arizona and promised to increase investment of $165 billion, it should be in line with Trump's exemption of taxes, but details must be announced until the 232 tax and the results of the Taiwan-US tax agreement will be announced next week.

Trump says he plans to put a 100% tariff on computer chips, likely pushing up cost of electronics