AMD Multi-headed analysts are optimistic about MI350, significantly increasing the target price

Analysts are optimistic that Ultramicro (AMD)'s MI350 series AI chips have the ability to compete with NVIDIA Blackwell AI chips, significantly increasing AMD's target price to US$200; AMD's share price rose by more than 4% in the 10th day.

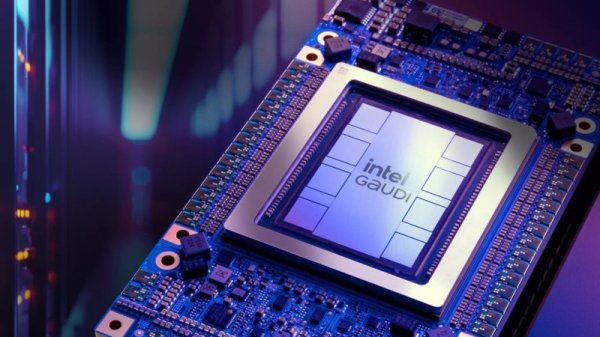

According to MarketWatch, the HSBC analyst team revised AMD's investment reviews from "holding" to "buy in" in the latest report, and raised the target price to $200 in one go, which is about 40% of the latest collectors.AMD released the Instinct MI350 series AI accelerator at the Advancing AI Conference in June this year, and shared the route diagrams of the new generation of products MI400 and MI450 series.

Analysts are happy with the pricing capabilities of the MI350 chips and believe that the MI350 has already competed with the rival NVIDIA, which can be on par with the Blackwell AI platform. In addition, the new generation of MI400 is expected to bring a new wave of upward potential in 2026.

Analysts also believe that the performance of the MI355 accelerator (which belongs to the MI350 series) is comparable to that of the NVIDIAB200 chips, and the average selling price is expected to reach US$25,000, which is 10,000 higher than the previous estimate, which is expected to help AMD's AI investment increase significantly in the 2026 annual survey.

Translation analysts believe that AMD's AI chip revenue in 2026 will reach US$15.1 billion, a significant increase from the previous estimate of US$9.6 billion.

AMD's share price rose 4.15% on the 10th, closing at $144.16, nearly doubled the low point of the stock market after the announcement of taxes.

Extended reading: AMD is happy to win a large order in Saudi Arabia, launching a $6 billion stock repurchase. Share price is hi