The memory market is booming, and the beneficiary stocks of Nanyako, Huabon Electric and CNK continue to close

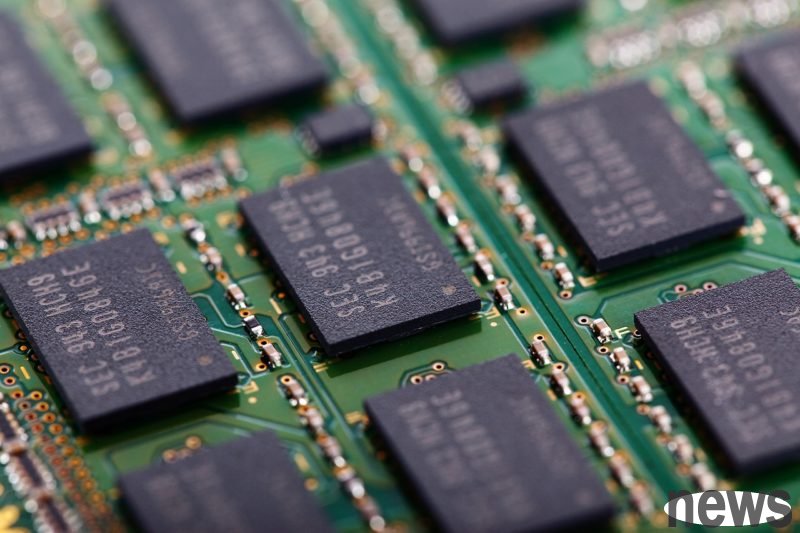

Recently, the DDR4 market has been in a hot market. In the second half of the year, the DRAM market has experienced a rising trend in supply and strong prices, which has led to the "price reduction" pattern in the PC DRAM market. In the future, DDR4 products will gradually withdraw from new machine configurations, which has led to the overall price trend. The NAND Flash market situation has seen significant improvements, especially as demand for enterprise-level solid-state drives (eSSDs) surges, which is expected to cause NAND Flash supply to be tight and push prices to rise. This aggressive trend may continue until 2026. Today, Taiwan stock memory stocks have become investors' price chasing targets.

The latest survey by TrendForce, the DDR4 market in the second half of the year was rising in demand and strong prices. Server orders directly under pressure on PC and consumer market supply. PC OEMs had to accelerate the introduction of DDR5 solutions. Consumer manufacturers faced high prices and were difficult to obtain materials. The supply and demand of DDR market also pushed up the price of DRAM contracts. The LPDDR4X surged in the third quarter in the past decade.

TrendForce emphasizes that the original DRAM factory and PC OEM have continuously agreed on a third-quarter contract price. Due to the limited production capacity and the production resources are skewed to the server market, most of the demand on the PC side is difficult to meet. In July, the price of PC DDR4 8GB module has exceeded that of the same capacity DDR5 module, with a rare "price reverse". Many PC OEMs have to repair the DDR4 machine's sales regulations and expand the DDR5 machine's ratio. Overall, DDR4 has shown a "price reduction" pattern in the PC DRAM market, and it has become a trend for DDR4 products to gradually withdraw from new machine configurations in the future.

NAND Flash market, Joe Moore's latest survey shows that the demand for artificial intelligence (AI)-based facility construction and hard drive (HDD) storage in super-large data centers is jointly driving the sales of enterprise-level SSDs to grow significantly. The demand for this stock has exceeded the previous level and is large in orders, and it is clearly shifting from the PC and smartphone markets. Among them, it is worth noting that data center storage is still mainly traditional hard drives (HDDs), accounting for as high as 85%~90%, while SSDs only account for 10%~15%. Analysis points out that even if only 1 percent of the storage combination is transferred from HDD to SSD, it will have a significant impact on the SSD market. This tiny transformation indicates a huge growth potential in the SSD market in the future.

For the above reasons, the supply of NAND Flash is under pressure, coupled with the limitations in capital expenditures and the technical conversion of the wafer factory, the impact is even stronger. NAND Flash's pricing power has been turned into a decisive positive in the fourth quarter. Prices for all types of NAND Flash products are expected to rise in the fourth quarter, and this aggressive pricing trend is likely to continue until 2026. This contrasts with the previous perception that some investors and analysts expect a possible price decline. If Joe Moore's forecast of all NAND Flash applications rising in December's single quarterly price, this will represent a market's general expectation that NAND Flash will begin to welcome a significant upswing space.

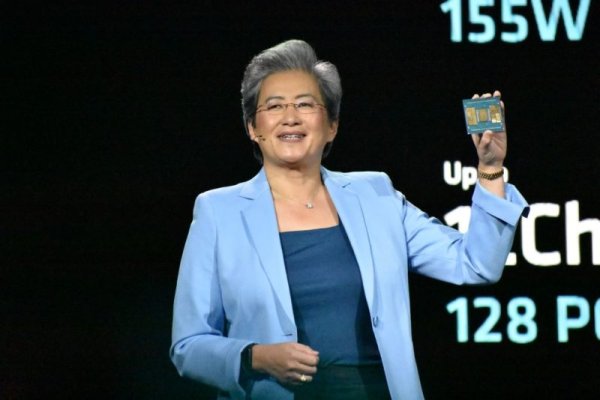

Due to the rising price trend of all products in the memory market, the memory stocks of Taiwan stocks in the 5th, Nanya Technology, Huafen Electric and Group Co., Ltd. all hit the stall price when they closed. Viagra and Wanghong also rose by 4.76% and 2.76%, becoming the focus of investors chasing prices.