McKinsey report: China’s rare earth control affects millions of German jobs

The latest research from consulting firm McKinsey shows that approximately 1 million workers in Germany are engaged in industries that are highly dependent on rare earth raw materials, including automobile manufacturing, energy and aerospace. If China interrupts supply, up to 4 million direct and indirect job opportunities may be at risk, and approximately 370 billion euros in output value, equivalent to 9% of Germany's gross domestic product, will be threatened.

China announced on the 9th that in the future, all exports involving rare earth mining and processing technology must obtain prior approval and further tighten export controls. The world is highly dependent on China's rare earths. Amid the trade confrontation between the United States and China, Beijing's rare earth policy adjustments have also affected the nerves of German industry.

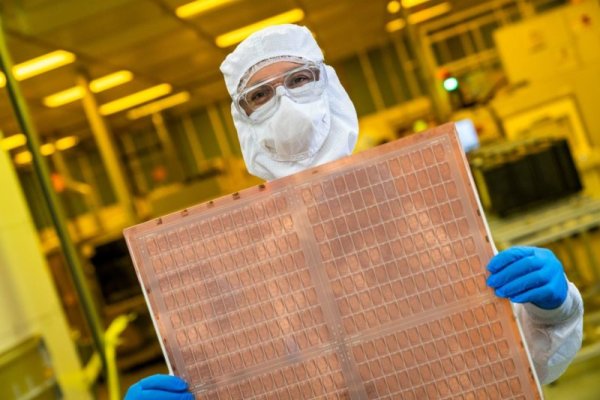

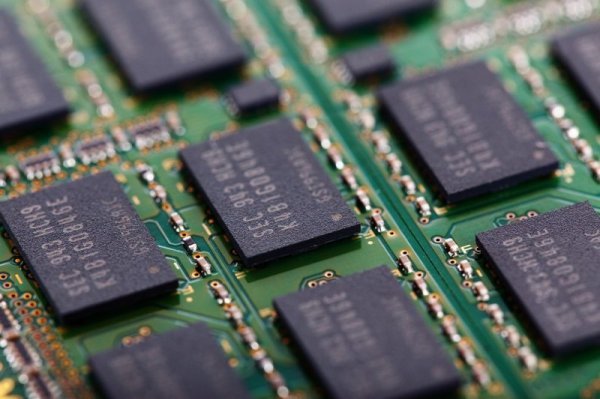

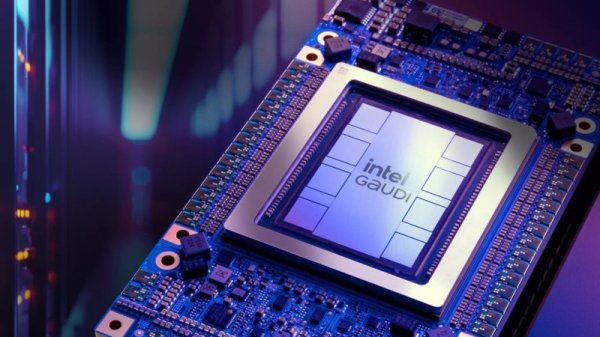

According to an internal McKinsey analysis report obtained by the German industrial media Handelsblatt, industries that use rare earths in the manufacturing process, such as automobile manufacturing, renewable energy equipment, semiconductors, machinery, and aerospace, contribute approximately 150 billion euros (approximately NT$5.3 trillion) to the German economy every year, and indirectly benefit approximately 3 million workers.

Once China restricts rare earth exports, the total direct and indirect impact may reach 370 billion euros (approximately NT$13.1 trillion), accounting for approximately 9% of Germany’s gross domestic product (GDP), and will have an impact on employment and Germany’s core industries.

Cornelius Bähr, an expert at the German Institute for Economic Research (IW), said that McKinsey’s estimate is reasonable. According to previous research by IW, approximately 1.3 million workers in Germany are engaged in the manufacturing of products containing rare earth ingredients. Once supply is interrupted, employment will be greatly affected.

Christian Hoffmann, a partner at McKinsey’s German office, told Business Daily that in the past, the industry’s focus on raw material issues was mostly focused on price fluctuations. Now, what is more important is whether the supply can be sufficient to support production.

Take Germanium, an important material for manufacturing optical fibers, semiconductors and military equipment, as an example. China announced at the end of last year that it would stop exports to the United States and significantly reduce its supply to the EU. As a result, European imports in the first half of this year fell by nearly 60% compared with the same period last year. A raw materials company revealed that European companies initially underestimated the risks, but now "the market is in panic and the industry is shocked."

Hoffman pointed out that although Germany has repeatedly proposed initiatives to ensure the supply of key raw materials in the past few years, whenever the market stabilizes in the short term, relevant policies have been shelved. He said that many companies have only recently realized that the security of raw material supply requires a long-term strategy.

Hoffman affirmed the "Rohstoff-Fonds" program established by the federal government last year and believed that this was the right direction to help companies develop new sources of rare earths outside of China.

The fund is provided by Germany's state-owned KfW (KfW) to assume project guarantee responsibilities, thereby reducing corporate risks and providing investment incentives. The government will also subsidize the cost gap to reduce China's competitive advantage in low-priced rare earths.

Hoffman suggested that cross-industry cooperation should be promoted, with the participation of manufacturing, mining, academia, banks and private equity funds, to establish a complete supply chain from raw material mining, processing to storage, and to establish a special procurement alliance or trade platform to strengthen negotiation capabilities in the international raw material market and further protect Germany's employment and industrial prospects.

Further reading: China's tightening of rare earth exports has impacted the world, and Western countries are striving for self-production. Overview of the situation Rare earth battle: Trump launches tariff war against China again, but hints at improvement China upgrades rare earth export controls, Ministry of Economic Affairs: Taiwan's semiconductor manufacturing process has not been affected U.S.-China trade war resumes, Beijing criticizes U.S. for hypocrisy and defends rare earth export restrictions China plans to tighten controls on rare earths. Experts: Taiwanese factories’ imports from Japan will have a huge impact To counter China’s rare earth export measures, Trump will impose 100% tariffs on China starting from 11/1