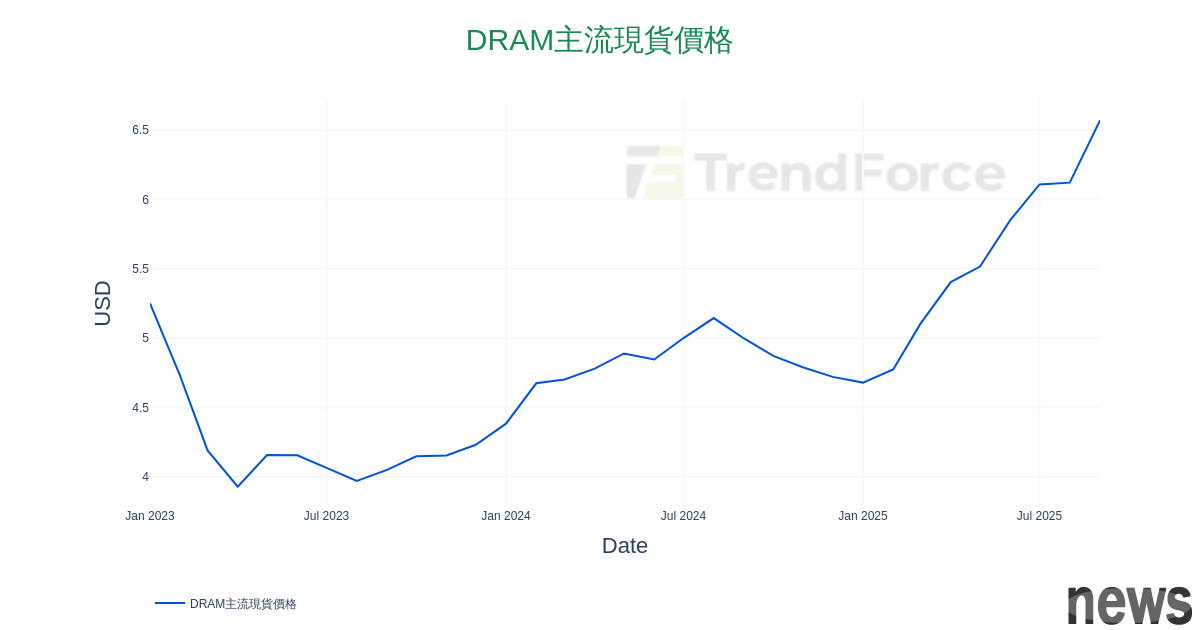

Memory industry’s capital expenditures next year will remain conservative, TrendForce: Supply will exceed demand throughout 2026

Memory market prices have been soaring recently, but judging from recent news, memory manufacturers are not expected to significantly increase the production of standard memories to meet the needs of the AI industry. According to a survey by research firm TrendForce, memory manufacturers are limiting capital expenditures on expanding production capacity and instead focusing on process technology research and development, increasing chip density through stacking, and producing higher-margin high-bandwidth memory (HBM).

Currently, Micron, SK Hynix and Samsung are expected to invest US$54 billion in capital expenditures, but the focus is on improving the performance of HBM modules for AI chips. Therefore, although investment in the DRAM industry increases by 14% annually, existing memory chip production will not increase.

Foreign media Tom’s Hardware speculates that the shortage may continue until next year, or even until 2027. Experts believe that due to the huge demand for AI chips and the continued advancement of infrastructure construction, high prices may last for ten years.

TrendForce pointed out that the capital expenditure of the DRAM industry is expected to reach US$53.7 billion in 2025, and is expected to further grow to US$61.3 billion in 2026, with an annual growth rate of 14%; for the NAND Flash part, capital expenditure is expected to be US$21.1 billion in 2025, and is expected to grow slightly to US$22.2 billion in 2026, with an annual increase of approximately 5%.

Read More at Datatrack

Read More at Datatrack

TrendForce expects that as the average selling price (ASP) of memory continues to increase, suppliers' profits will also increase. Under this situation, subsequent capital expenditures for DRAM and NAND Flash will also continue to rise, but there will be limited investment in output growth in 2026, and it is expected that the shortage of NAND Flash will continue throughout 2026.

Although the current market demand for memory and storage chips is strong, according to the industry, there is already a bubble in the AI market. Analysts believe that if all infrastructure investments are to be rationalized, annual revenue must reach at least US$650 billion.

Memory chip manufacturers are still cautious about investing billions of dollars in building new production lines. If demand is not as good as expected, billions of dollars of investment may be lost. Even if a new factory is built now, it will take at least several years to be fully operational. Therefore, memory manufacturers prefer to focus capital expenditures on technologies with higher returns and better efficiency, such as revamping existing DRAM production lines rather than building new production lines. However, the cost is that the production of memory modules for consumers will decrease.

Memory Industry to Maintain Cautious CapEx in 2026, with Limited Impact on Bit Supply Growth, Says TrendForce Memory makers have no plans to increase RAM production despite crushing shortage memorys — ‘modest’ 2026 increase predicted as DRAM makers hedge their AI bets Further reading: Damon supports Meguiar! The target price rises to US$325, optimistic about strong profit momentum and listed as the top pick. Qualcomm's first industrial-grade computer processor Dragonwing IQ-X, first adopted by Advantech, NEXCOM, etc.