Viagra earns 32 yuan per share and purchases electric tool manufacturing power of up to 69.9% shares

On the 1st, the memory model factory Wei and the air gun manufacturer, Li Yan, announced at a major message reporter meeting held at 2:30 that with the consent of the board of directors, it decided to open the public acquisition of the common shares issued by Li Yan at a price of RMB 32 per share.

With said that the expected maximum purchase volume is 36 million shares from October 21, which is approximately 69.9% of the shares. At the same time, the minimum purchase volume was 18 million shares, accounting for about 34.95% of Liken's shares. The total amount was NT$1.152 billion, and the total amount was from its own funds.

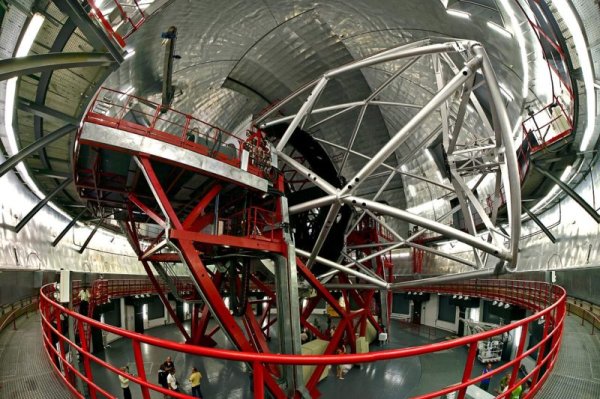

According to Viagra, Liken is a professional OEM air-powered gun manufacturer in Taiwan, and its products include professional air-powered guns, electric guns, and auto repair tools. This public purchase is mainly based on strategic investment purposes, combining the mutual benefits of dual-party business, production, technology and end sales, adding positive contributions to the future business and operation development of dual-party. In addition, it can increase Viagra's reasonable investment income and improve Likeng's assets and shareholders' rights return. In the future, both parties will make good use of their respective core advantages to accelerate the expansion of their careers.

Vision is a professional energy and electric tool manufacturing factory, mainly based on foreign sales. Since its establishment, the company has not only had a very healthy financial structure, but also has a stable operation. It has distributed good cash dividends for 10 consecutive years. In addition, the company has accumulated many important business dealers over the years, it will make positive contributions to the development of Viagra and Motorcycles. After the completion of this purchase, Li Ken did not terminate the plan of the upper cabinet.

Recently, the price trend of the benefit memory that the increase in market demand and supply cannot be affected by the increase in prices, and the closing price on September 30 came to the NT$157 per share, with the stock price not only surpassing 135% in half a year, but has even reached a new high for more than 18 years. According to the previously announced August revenue performance, the amount is NT$4.983 billion, a growth of NT$16.9% in July and 64.5% in the same period in 2024. In summary, the revenue in the first eight months was RMB 31.928 billion, which is also an increase of 18.3% over the same period in 2024.

Liken Trust was founded in 1979. Its energy tool research and development and manufacturing is the main industry, especially in the professional energy and gun field. The company has been deeply engaged in the tool and machinery market for a long time, and its products cover electric tools, manual tools and electric tools, and produce spare parts, and engage in related import and export trade.